Digital Financial Closing – Four Critical Steps. Technology is not the Saviour!

AUTHOR: KNUT HAUGLAND

SENIOR ASSOCIATE CONSULTANT

Knut is a Senior Finance professional with 22+ years of global experience. He specialises in Finance Transformation and Internal Audit, with particular expertise in Risk & Financial Controls, Process Design & Deployment, and Shared-Services Optimisation.

Why Consider a Digital Financial Closing?

As Digital Transformation gains significance, let’s explore the financial closing and the potential for enhanced digital transformation, which can bring significant benefits.

Finance professionals often see the closing as painful. It is associated with long hours, weekend work, endless adjustment journals compensating for an inadequate or not fit-for-purpose ERP set-up, or error-prone masterdata – to mention a few of the difficulties. New on the table may be the ESG data and reporting requirements to comply with the CRSD.

These challenges often lead to laborious, manual workarounds, excessive spreadsheet use, reconciliation issues, and difficulties producing accurate, usable Management Information for internal use or as a feed for external reporting. Imagine the relief of being liberated from these tasks, allowing you to focus on more strategic and value-added activities.

Opportunities for Automation

Digital Transformation or Automation can significantly reduce or even eliminate the pain points and labour intensity of a financial closing. Opportunities exist for the automation of process steps, such as:

- running ERP transactions and programmes

- workflow approvals

- consolidation of a multi-company set-up

- account reconciliations

Here are three forms of possible automation:

Robotic and intelligent automation solutions are the most readily applicable in the financial closing process.

Is Software the Answer?

You may have searched the Internet for the topic. In that case, you will have found a wealth of companies offering various software solutions that enable your organisation to increase the automation of Finance processes.

When looking at the ocean of software solutions on offer, implementation often appears like a straightforward and cost-efficient exercise. The return on investment promised is undoubtedly appealing. However, the challenge is usually in something other than the technology itself. In fact, from our analysis, different solutions often offer similar functionality. Selecting a solution comes down frequently to organisational preference and fit. It is, however, worth emphasising that the implementation is not as easy and quick as the advertisements and sales pitches might have you believe.

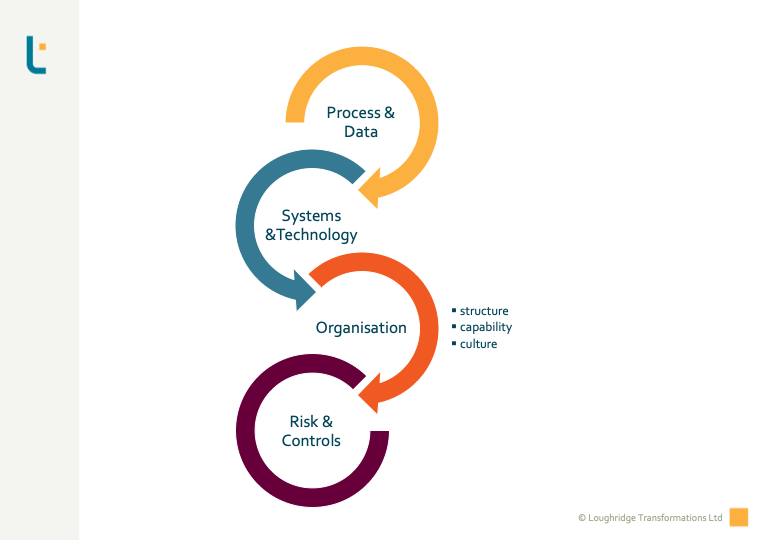

Pre-Requisites for the Digital Financial Closing

Regarding the time and money invested in automating the Financial Closing process, we would argue that you should budget far more for the “prepare-for-automation” phase and the organisational readiness phase than the actual cost of the software IT infrastructure. Whereas the software cost is mainly fixed, the preparation and readiness phases and associated costs can vary from organisation to organisation, depending on the organisation’s circumstances, size, and complexity.

Process

Finance processes are often run via institutional memory rather than clear and specific protocols. The various people involved “just know how things get done.” A lack of standardised and documented procedures and routines hinders efficient automation. The more multi-national the organisation is, the bigger the problem becomes. We often see a loose list of month-end tasks in spreadsheets – usually not shared or visible across geographies or divisions. When and whether the tasks get completed each month is often anyone’s guess. However, technology helps, and documentation and task-tracking are critical to capture real efficiency gains in the closing process. Automating processes without clearly understanding the dependencies and task durations is almost impossible. Assess each task in the close process to determine its value and reason.

Data

To start, think about how you are managing the masterdata. By masterdata, we mean a harmonised chart of accounts, reporting entities, cost and profit centres, industry and company attributes, and so on. Let’s imagine you have automated your ERP programmes/transaction codes (for example, cost allocation, depreciation, and so on). However, if your masterdata quality is low, the ERP programme will likely halt due to errors. A resolution will require manual intervention. It is somewhat like having a hi-tec remote control starter for your car while having some underlying problems with the engine. It results in your car breaking down a mile along the road every time you set out. If some fundamentals are missing, what have you gained?

Organisation

Once the process understanding is as above, it is much easier to get a good overview of the people involved, specifically the process operators. Before Transformation (digital or otherwise), most staff working on the closing will spend their time in one or more of the following:

- Generating or Inputting data;

- Finding problems; and

- Implementing workarounds

The critical organisational pre-requisite is to get the organisation to develop or improve a process mindset. That means defining standard ways of working and enhancing the underlying process instead of solving problems by workarounds. Our blog on Sustain the Change addresses this in more detail. Post-transformation, you will typically find that finance staff monitor and supervise processes and validate system activities. This shift must be prepared for via new role definition and training as part of the deployment. We cover this in our blog on Getting Your Finance Organisation Ready for Digital Transformation.

Controls

For those experienced control operators, there is no need to explain how time-consuming this task can be – even more so when operating manual controls. Typically, you find such controls within the:

- reconciliations of accounts

- between ledgers

- Excel-driven calculations

- and on and on!

Many manual controls become redundant in a system-driven, automated closing process as system controls supersede them. This liberation from manual controls means more time for analysis and less time spent on repetitive tasks. In addition, system controls give more robust assurance, as they do not rely on judgment and discretion in the control execution. Lastly, system controls do not require frequent Operational Effectiveness testing. An annual IT test is typically sufficient to ensure the system software “does what it says on the tin”.

Waterfall or Agile Delivery?

The good news is that not all pre-requisites must be completed before any automation deployment. The deployment can be concurrent, piece-by-piece, or in whatever way and at whatever pace suits your organisation best. However, it’s crucial first to understand your current situation through a detailed AS-IS analysis. This will provide a clear picture of your pain points and guide your transformation strategy.

Such AS-IS analysis should result in a detailed description of your pain points. It could, for example, be inaccurate data caused by excessive use of spreadsheets, leading to error fixing and re-work. Reporting functionality may be poor as useful Management Information cannot be extracted directly from your system, so it has to be re-worked via spreadsheets. That, in turn, leads to a heavy workload for staff, resulting in overtime and little time for value-added analysis. Whatever your issue within your closing process, it is crucial to understand what you are trying to solve. Our Loughridge Transformations‘ “Nine Steps” method is invaluable in that analysis.

Digital Financial Closing – Practical Examples:

For simplicity, let’s say your financial close starts on the last workday of the month, WD-1, and ends with reporting your monthly, quarterly, or annual results on WD+10. This schedule is often your organisation’s critical path in the financial closing. Each day will have specific tasks with deadlines. A delay on any particular day will impact the subsequent tasks and activities. The aim is to analyse if you can remove items from the critical path – even more so for those time-consuming activities.

Running depreciation is a good example. Many companies have successfully removed the fixed assets depreciation activities from the critical path by running them one month in arrears. Naturally, that change needs an agreement with the external auditors. However, the impact is that you can run depreciation on, say, WD-5, which gives you plenty of time to resolve any errors before the critical path.

Reconciliations are another example. Moving to a weekly reconciliation cycle means reconciling only one week’s worth of transactions rather than one month’s worth. Next, consider whether your organisation struggles with many accounts. If so, you could identify a much smaller set of critical accounts. Only these accounts would be subject to reconciliation during the critical path. The team could reconcile all other accounts outside of the closing period.

Which Tasks are Best-Suited for Automation?

The simple answer is that any job in your closing process which utilises your ERP is suitable for automation. However, before you automate the task (ERP transaction code), you should be comfortable with the transaction running smoothly. Suppose, for example, that you are consistently experiencing ERP jobs that fail, such as postings to closed cost centres, and, consequently, need manual intervention. In that case, there is little point in automation, as the job will still not run to completion. You will likely require a more permanent fix before automating the transaction. This example reiterates the importance of your organisation’s “readiness-for-automation” phase before embarking on the automation journey within your closing process.

In summary, we fully endorse any ambition to automate – however, don’t make the mistake of relying on software to fix underlying problems – that being clean-up of process, masterdata or human behavioural aspects.

How can Loughridge Transformations support your Digital Financial Closing?

As a process-led, people-led Finance Transformation practice, people are always at the core of our design solutions. Loughridge Transformations focuses on organisational structure, capability, and culture while ensuring process design reflects the latest digital developments. We provide successful and sustainable delivery through the Loughridge Transformations’ Nine Steps to Finance Transformation.

Loughridge Transformations can offer – with no further obligations – short virtual workshops that your organisation can use as the first building block in Finance digital transformation.

Get in touch if you want to explore this or any other automation aspect in the financial close!

Alternatively, take a look at our most popular blog posts:

Or are you looking for something else? Here’s what we have been blogging about recently:

Agile Analytics Associates Automation Behaviours Building Trust Business-Partnering CFO Remit Change Management Coaching Collaboration Continuous Improvement Control Design Control Framework Corporate Governance Data Deployment Digital ERP ESG Finance Function Finance Transformation Implementation Migration Off-Shoring Organisation Organisation Design Process Process Design Process Improvement Process Performance Productivity Project Management Readiness Regulatory Compliance Risk & Controls Skills sponsorship Standard Organisational Model Strategy Systems Systems Design Technology Transformation Virtual Working