Strategy: How to Supercharge Finance Transformation

AUTHOR: JENNIFER LOUGHRIDGE

PRINCIPAL CONSULTANT

Jennifer is a Senior Executive Finance professional with 22+ years of global experience. She specialises in Finance Transformation, ESG and Continuous Improvement, with particular expertise in Strategy, Performance Management, Business Partnering, Commercial Decision-Making, Corporate Governance and Valuation.

Our introductory post in this series began with an overview of the Nine Steps to Finance Transformation. This post will focus on the first of the nine steps: supercharging your transformation using strategy. First, we will look at the importance of strategy and then why it is an essential step. Finally, we will look at what is critical for Finance Transformation.

Is Strategy an Essential Step?

It may be an obvious place to start, but organisations sometimes overlook it. This is especially true when taking an off-the-shelf product or considering only a small component of a more extensive transformation. However, it is worth doing, even if only approached with the lightest of touches. Skipping this step means you risk missing the necessary input to make vital decisions in subsequent steps, such as the degree of sophistication in potential solutions or the standardisation required by your function. So, even if this step only takes thirty minutes of thinking, we recommend doing at least that.

When embarking on a significant Finance Transformation, a clear strategy is a must. Without it, the transformation may lack direction, leading to potential wasteful cost and resource decisions. This is where Loughridge Transformations can play a crucial role, ensuring a robust strategy guides your transformation journey.

If your organisation already has a well-understood and communicated strategy, you can use that to guide you. Alternatively, you might need to work with what is available, however well or poorly defined.

Which Strategy Outcomes are Required?

As mentioned above, a light-touch approach may mean, at most, thirty minutes of reflection. In other situations, a facilitated workshop or even a series of workshops is required. Often, a third party, such as Loughridge Transformations, can be very impactful in running such sessions. In addition to providing an external lens, a third party can create space for the CFO and other functional leaders to focus on the questions at hand.

It is also often worth leveraging external expertise to ensure that the focus is on the parts of the strategy most relevant to the later steps in Finance Transformation. If that focus is missing, this strategy step can feel like a tick-box exercise rather than value-adding, as the needed inputs for the later steps will be overlooked.

Loughridge Transformations can tailor a workshop to fit the scale and complexity of the transformation – and you may wish to combine it with the introductory session mentioned in our last post.

How should you use your Business Strategy?

Of course, the answer to how you should use your Business Strategy depends on your specific strategy. However, understanding and actively using your Business Strategy is not just a key but the key to a successful Finance Transformation. It empowers you to steer the transformation in the right direction and maintain control over the process.

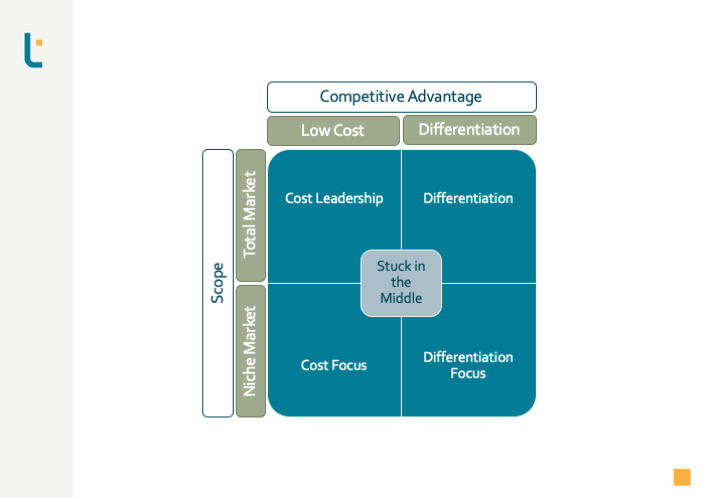

However, to help explain the approach, we will refer to Porter’s Generic Strategies. If you are unfamiliar with Porter’s model or want to look into it more, you will find it in many strategy textbooks. His original publication is from 1985: Competitive Advantage: Creating and Sustaining Superior Performance.

Cost Leadership

We start with the top-left quadrant – cost leadership.

An organisation in this quadrant will aim for efficient, standardised processes with high accuracy.

Technology (including digitisation) will be deployed where it supports those goals but not more.

The organisation will be lean and cost-effective, potentially focusing on innovation and improvements that maintain or improve its cost leadership position.

Differentiation Focus

We move to the bottom-right quadrant – differentiation focus. Here, it depends on what the organisation has defined as its differentiator. Let’s consider, as an example, excellent customer service.

The organisation, here, will also aim for efficient and standardised processes with high accuracy. However, process flexibility may be allowed where it improves the customer experience.

Technology will likely mirror processes, and solutions will focus on enabling a positive customer experience.

Given the process flexibility, the organisation may have pockets that are not so lean to the benefit of customer service.

The organisation will likely also have space to look at innovation or improvement that maintains or improves its differentiators.

Differentiation

We then move to the top-right quadrant. Here, the organisation is looking at a mass-market position. The trick is to get the right balance on the pieces described above. This balance ensures the organisation achieves the best of both rather than the worst of both!

The Impact of Strategy on the Function

You may already see how each scenario’s strategic makeup influences the Finance Function’s scope and delivery. For instance, in a cost leadership strategy, the finance function may focus on efficiency and standardisation, while in a differentiation-focus strategy, the focus may shift to customer experience. Consequently, this makeup is critical to the scope and design of a Finance Transformation programme.

Using Strategy on a Smaller Scale?

Perhaps it is now clearer why strategy is essential in a larger-scale programme. But why does Loughridge Transformations advocate not skimping on the strategy step when the activity is on a smaller scale? Let us look at a practical example to illustrate its value.

A Practical Example

You have received the audit report from your external auditors with audit findings, including:

- weak control framework

- lack of adequate risk mitigations

- and more.

You are responsible for resolution as a senior manager with accountability. At first glance, the most apparent course of action might be “simply” reviewing the audit findings, re-designing the control(s), and subsequently deploying the updated controls. Indeed, your primary focus might be to “just” ensure compliance. Indeed, compliance is a strong driver if your organisation is subject to a regulatory framework like Sarbanes-Oxley.

However, this approach is a short-term fix because no one has examined the underlying causes of the control failures. Without looking at the root causes, the solutions deployed are not likely to be successful or sustainable.

By taking the time to understand the strategic positioning, you will spot symptoms more readily and get to the real issues you need to resolve.

Again, an external and experienced pair of eyes, such as we have at Loughridge Transformations, can be invaluable.

Using Strategy to Spot Symptoms

To tackle the audit findings successfully and sustainably, you must understand what is causing the control failures.

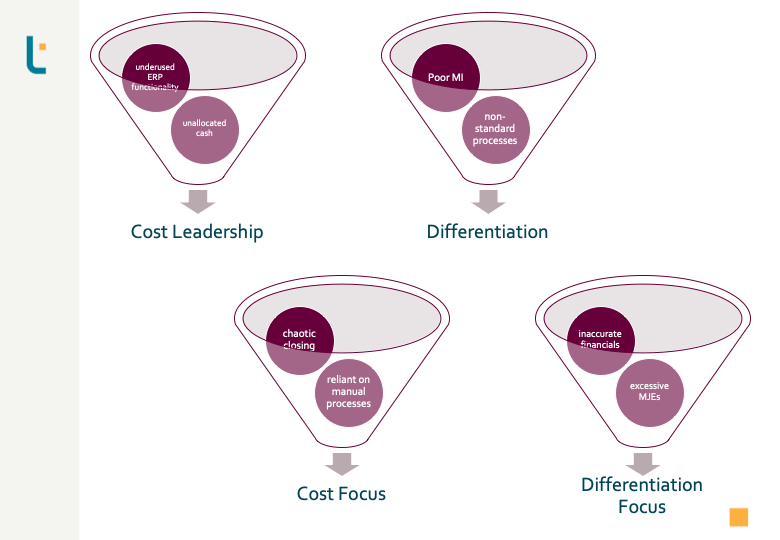

It might be that processes are not standardised or manual processes are not robustly automated. You might even have unused functionality in the ERP or other technology. It is more common than you might think. It is easier for individuals to continue doing what they have always done than to use something new! There may even be gaps in functionality, and the ERP is no longer fit-for-purpose.

Perhaps the design quality of your controls is top-quartile, but the deployment did not consider change management properly. The result is that the controls are operating ineffectively – even if the team designed them effectively.

Using Porter’s Generic Strategies, we highlight typical symptoms of each quadrant. Knowing in which quadrant the organisation sits gives you a head start in understanding the symptoms of those control failures.

A Familiar Story?

There is something else that we have come across frequently. An organisation may have state-of-the-art products and/or services to customers locally or globally and have good financial performance. However, it is not a given that the Finance Function is in good health. It is not uncommon to find finance departments in a constant fire-fighting mode. Sooner or later, a fire-fighting finance department will affect the overall organisation. Examples could be:

- suppliers are not paid on time

- unreconciled bank statements lead to unallocated cash stemming from customer payment

- an inability to produce reliable and meaningful Management Information for decision-making

- a chaotic closing process failing to provide accurate financial reports

- excess manual journal entries due to a high number of accounting corrections.

The list can be a long one. Moreover, these items are symptoms that help identify and address the root cause. If not resolved, these symptoms will eventually push the organisation into a quadrant that is not the chosen strategic positioning or, worse, “stuck in the middle”.

Besides, a Finance Function partly or wholly in fire fighting mode is not a happy workplace. If the situation is left untreated, staff will become demotivated. Attraction and retention issues will build on the existing problems, leading to a downward spiral.

…and the Good News?

The good news is that once the strategic positioning is understood, the symptoms assessed, and root causes identified, you are on the road to improving the situation and implementing successful and sustainable solutions. Again, an external resource, such as Loughridge Transformations, can tailor-make one or more workshops or assessments that will crystallise today’s reality.

From that, a prioritised list of short-term “must-do” items, medium-term “needed” or “highly desired” items, and long-term “edge-over-competitors” items can be compiled. As always, Loughridge Transformations’ scope can be tailored to suit the organisation’s needs and budget. That can range from part-time resourcing to a full-blown team of experienced, individual Subject Matter Experts and end-to-end delivery.

Interested in More Finance Transformation?

Our next post will focus on the second step — determining the finance functional fit. We will introduce our five-part model and examine the modular aspect of the Loughridge Transformations method.

Have you missed some of the other posts in this series? Find them here:

-

Nine Steps to Finance Transformation

An introduction to a series of blog posts on nine scalable and modular steps to deliver successful and sustainable Finance Transformation.

-

Strategy: How to Supercharge Finance Transformation

The Loughridge Transformations approach to strategy.

-

Finance Functional Fit: The Most Critical Scope Definition You Need

The Loughridge Transformations method of determining the Finance Functional Fit – the most critical scope definition you need.

-

Baseline Definition – A Reliable Assessment Model for the Finance Function

Step 3 in the Loughridge Transformations method of Finance Transformation: Baseline Definition

-

Define the Future – Target Setting & Benchmarking

Step 4 in the Loughridge Transformations’ method of Finance Transformation: define your future – setting targets and benchmarking.

-

Choose The Lever for Successful Finance Transformation

Step 5 in the Loughridge Transformations’ method of Finance Transformation: Choose The Lever – how to achieve the targets.

-

Finance Transformation: Understand The Context to Secure Excellence

Examining the importance of understanding what’s happening around you and identifying what could impact your Finance Transformation.

-

Delivery – Design and Prepare for Robust Finance Transformation

The Loughridge Transformations approach to delivering the design phase of projects.

-

Deployment for Finance Transformation: Ensuring a Successful Go-Live

The Loughridge Transformations approach to the implementation phase of projects.

-

Sustain the Change: Finance Transformation to Last

The Loughridge Transformations way to actively reinforce the new practices and monitor their impact to pave the way to drive your Finance Transformation forward

-

Reviewing the Nine Steps to Finance Transformation

A summary of the series of blog posts on nine scalable and modular steps to deliver successful and sustainable Finance Transformation.

If you would like to speak with one of our consultants to discuss the above, please feel free to contact us!

Alternatively, take a look at our most popular blog posts:

Or are you looking for something else? Here’s what we have been blogging about recently:

Agile Analytics Associates Automation Behaviours Building Trust Business-Partnering CFO Remit Change Management Coaching Collaboration Continuous Improvement Control Design Corporate Governance Data Deployment Design Principles Digital ERP ESG Finance Function Finance Transformation Implementation Migration Off-Shoring Organisation Organisation Design Process Process Design Process Governance Process Improvement Process Performance Productivity Project Management Readiness Risk & Controls Skills sponsorship Standard Organisational Model Strategy Systems Systems Design Technology Transformation Virtual Working

9 thoughts on “Strategy: How to Supercharge Finance Transformation”

Comments are closed.