How to Design an Organisation to Respond to the Needs of the Customer

AUTHOR: JENNIFER LOUGHRIDGE

PRINCIPAL CONSULTANT

Jennifer is a Senior Executive Finance professional with 22+ years of global experience. She specialises in Finance Transformation, ESG and Continuous Improvement, with particular expertise in Strategy, Performance Management, Business Partnering, Commercial Decision-Making, Corporate Governance and Valuation.

Finance Organisational Model – Why Do You Need a New Design?

Several triggers may necessitate a re-evaluation and potential redesign of your finance function through new organisational models. These triggers could include the growth of the function or the overall organisation over time, a merger or acquisition that has brought several functions together, or rapid organisational growth that has outpaced the capabilities of the existing functions. Other triggers could be the need to enhance digital capacity and capabilities or the realisation that the cost and outputs are unacceptable or below-benchmarked expectations.

As recent research at Gartner indicates, in 2022, there are further triggers:

CFOs and Finance Executives are continuously assessing and revamping their finance strategy in response to the changing needs of internal and external customers. Organisational structure re-design is one of the ways Finance can effectively adapt to these evolving needs.

Finance function leaders have long focused on standardising workflows and roles to increase efficiency, but standardised models proved brittle during the volatility of COVID-19. The impact of rising organisational complexity on finance’s closeness to decision-makers cannot be overlooked. Today, decisions are made more quickly and at lower levels within the organisation, which increasingly limits finance’s ability to remain updated on decision-makers’ business priorities and challenges throughout the organisation.

Gartner 2022

Finance Organisational Model: Getting It Right

Whatever drives you to embark on this change, proactively designing and deploying a new organisational model, including the relevant structure, competencies and behaviours, means you maximise the use of team members’ skills. You also avoid inconsistent or sub-optimal delivery from human- and machine-based roles. Introducing (or deepening) a shared-service model or outsourcing services to a third-party provider makes this more critical. Addressing these ultimately improves the relationships with business partners and the team’s morale.

So, how do you get it right? How do you ensure your model addresses the needs of internal and external customers and all the transactional and business-facing teams?

Finance Organisational Model – Setting the Scene

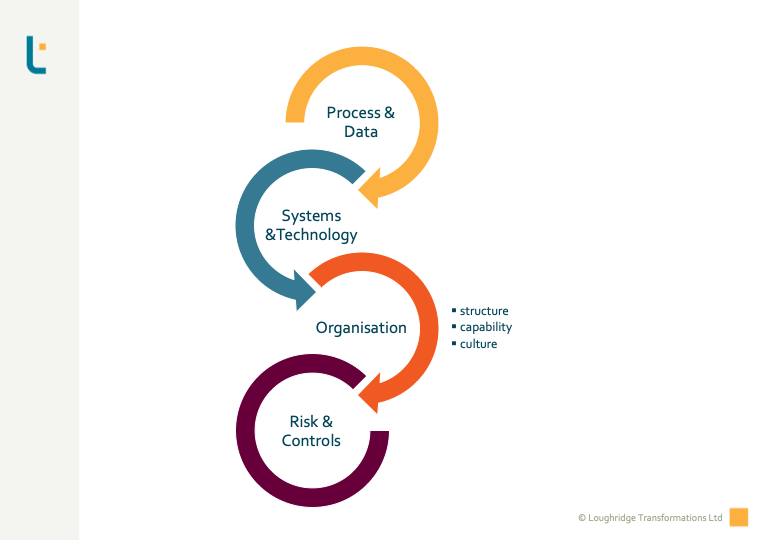

Before going any further, let’s clarify where the organisation – specifically structure, capability and culture – fits into overall Finance Transformation.

Here is the Loughridge Transformations Four Elements of Transformation Model, a comprehensive framework for your Finance Transformation journey. This model starts with Process and Data, the foundational elements. Next comes Systems & Technology, Organisation and Risk & Controls. Each of these elements plays a crucial role in the transformation process, and understanding their interdependencies is critical to successful transformation.

In addition to understanding the Four Elements of Transformation and how they relate. It is also helpful to have a basic understanding of the types of organisational structures:

When designing an organisation for a function, there is often limited freedom. Of course, the functional organisation must fit within the overall organisation logically and workably.

Of course, you have much more freedom when looking at an entire organisation. However, as the video alludes to, the organisational strategy and culture will impact your choice. Therefore, how much genuine choice you will have in the design here depends on how far-reaching the transformation is.

Loughridge Transformations‘ Step-By-Step Model

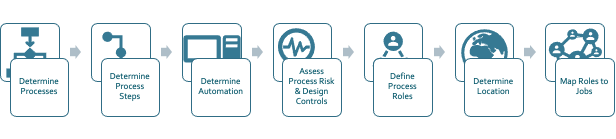

So, we now reach the point where we share the Loughridge Transformations step-by-step model for achieving Effective, Efficient, Well-Controlled and Sustainable Performance.

You might be looking at the model now and thinking, “Wow, fourteen steps! That is a lot. That is probably too much for my organisation!”

At Loughridge Transformations, nearly all our models are “scalable and modular.” Everything we do can work standalone or be fitted together. It also means that the principles can be applied to small, large and global, multi-national scales of organisations.

The fourteen steps above can work in the most sizeable organisations with thousands of Finance staff. However, it also works at the other end of the spectrum. We have successfully used this model with organisations at both ends of that spectrum, demonstrating its adaptability and applicability across different organisational sizes.

There is far more detail behind each step than we could do justice to in a blog post. So, today’s post will serve only as an introduction.

Finance Organisational Model – Step 1: Determine Processes

Our Four Elements of Transformation start with Processes. If you are unfamiliar with what is involved in this step, check out our recent post on Process Models:

Finance Organisational Model – Step 2: Determine Process Steps

For each process in scope, you will need to determine the steps at a sufficient level of detail, at least, to define roles later. This involves understanding Process Hierarchy and levels of design, which is a structured approach to breaking down complex processes into manageable components. Our Process Model post provides more insights into this.

Finance Organisational Model – Step 3: Determine Automation

This step is mainly about understanding which activities will be executed by a machine and a human. Here, you want to ensure you have fully exploited the functionality of the existing or new technology. The ‘Essential Ladder of Implementation’ tool can help you do this effectively. It provides a step-by-step guide to implementing automation in your processes, from basic to advanced levels. Our post on this can offer more insights.

-

Upgrading your ERP? Here’s How to Get It Right.

The same steps are crucial whether you are implementing from scratch, replacing or upgrading your ERP. Follow our ladder to get it right!

Finance Organisational Model – Step 4: Assess Process Risk and Design the Controls

Process risk is a topic in its own right, so we will not delve into it here. However, it is an important topic, so we plan to feature this in an upcoming blog.

Finance Organisational Model – Step 5: Design Process Roles

All human- or machine-operated roles should be included at this stage. That way, the link between process steps and organisational execution is clarified. That’s also why the design should incorporate control operation. It also makes combining work instructions and control operation procedure documentation much easier later in the design. That, in turn, simplifies things for the process or control operator. The same goes for user access profiles. Completing an end-to-end overview of the technology makes it transparent what is machine-operated and what a person does. Identifying the correct user-access profiles for the process operators also becomes much more manageable. Naturally, this also sheds light on the Segregation of Duties conflicts when drawing up the design.

Non-Transactional and Non-Routine Activities

It may be helpful to reflect on what this means when considering non-transactional organisational activities, both routine and non-routine.

These activities, for functions, usually comprise the bulk of Business Partnering and Centres of Excellence activities. On the other hand, anything transactional and routine properly belongs in a shared-service set-up, whether off-shored or outsourced.

Process Design is often far less detailed in this space. As a result, design teams usually avoid fully including this in the scope. At Loughridge Transformations, we understand why that happens. However, we strongly caution against it.

The result will be an organisation where the right-hand doesn’t know what the left hand is doing. In practical terms, that means messy hand-offs, the potential for duplication and error, a poor grip on controls, and team behaviours that don’t support the organisation’s sustainability. As a result, it will scarcely take you to top-quartile performance and not world-class performance levels.

It is all very well, but it is often left out of scope because it is difficult. It may be more difficult, but it is merely different and requires an alternative approach.

Is your organisation considering transforming the non-transactional activities? Then, don’t hesitate to arrange a call with us to learn how we execute this part of the design.

Finance Organisational Model – Step 6: Determine Location

There are some considerations in terms of location when designing an organisation model. One primary driver is the synergies available in terms of cost, efficiency and resource availability when looking at potential consolidation or centralisation. That can drive the off-shoring approach to shared-service locations or Centres of Excellence – for the finance back-office, IT and Customer Support, to name a few examples.

Language ability is often a significant consideration, and the potential locations need a good talent pool. In addition, the proximity of some activities (usually in affiliate roles) can be an essential productivity enabler. Sometimes, the positioning of roles is driven by strategic locations based on the market or business prioritisation, where the volume of business or the market positioning determines the location of a designated hub.

Larger organisations can benefit from a “follow-the-sun” schedule, usually configured as three eight-hour shifts in different parts of the world. So think about starting in Asia, passing the baton to Europe, passing it to the Americas, and returning it to Asia.

Sometimes, there are trade-offs when working across time zones – you will still need enough overlap in working hours between business-proximate and shared-service team members to make it all work. Perhaps some of that can be addressed by shift patterns, which may only be needed during critical month-end schedules. Alternatively, it may drive which centre works with which location, or if you only have one shared-service location, where it is located vis-à-vis the business locations.

Finance Organisational Model – Step 7: Map Roles to Jobs

So, to be precise, we don’t map roles to an individual. Instead, we map roles to jobs and assign a job to a named individual. Of course, this step must work hand-in-hand with the previous step, i.e., location determination.

When doing this role-to-jobs mapping, we usually start with the standard mapping. As a result, we will have a set of standard jobs. However, we usually will end up having to localise standard jobs. This localisation means we will add or remove particular roles for the job, essentially creating a variance of that job.

Why do we do this? It is usually for efficiency or mitigating any compliance issues. For example, in smaller business operations, a standard job may not justify one whole FTE. In this case, we can combine more than one job or assign additional roles to a job — as long as it doesn’t create any Segregation of Duties conflict.

The Perfect Design?

We must realise that it is still a desktop exercise for organisational design. Therefore, no matter how good you are, there will need to be iterations to get it right. Moreover, in our experience, this step is best done when the Design Authority understands the organisational drivers and the actual content of the roles and standard jobs.

Some will try to use the organisation’s metrics, such as turnover, capital employed and so on. But, frankly, this is no substitute for having a proper grasp of the business and the Function.

When moving from design to deployment, we prefer to apply skill, expertise, and good collaboration with the impacted organisations. Of course, you need to understand the scale of operations. Still, understanding the complexity or lack of it and a thorough discussion around fiscal and legal restrictions is far more valuable.

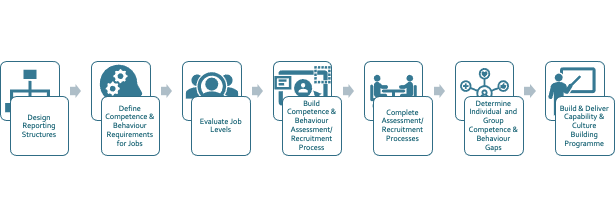

Finance Organisational Model – Step 8: Design Reporting Structures

As mentioned in the video above, this can be rather organisation-specific, so we will not touch on that here.

Finance Organisational Model – Step 9: Define Competence and Behaviour Requirements for Jobs

In brief, jobs will likely change materially if you transform an organisation. Some jobs will cease to exist, and new ones will come in. On top of that, the location could also have changed. Ultimately, you can see many changes in people and jobs.

So, it is a given that there will also be changes in the skills and behaviours needed. Consequently, if you are unclear on the new skills and behaviours, how will you know if the individuals appointed to the positions are ready to succeed?

It is 100% the key to your change’s efficiency, effectiveness, and sustainability.

Finance Organisational Model – Step 10: Evaluate Job Level

This step evaluates the job level: how junior or senior each job will be in each location.

Finance Organisational Model – Step 11-14: Capability Assessments and Programmes to Build Capability & Culture

Steps Eleven to Fourteen are all about assessment and recruitment, and eventually full deployment of the capability and culture or, you might say, skills and behaviours. We won’t cover those in this post as some elements depend highly on the legislative framework within which you work.

Finance Organisational Model: Our Approach

In this post, we have introduced the steps in our organisational design and deployment approach.

We are happy to discuss our methodologies and working methods with you if you want to learn more about them. For example, suppose you are considering an organisational re-design or complete transformation or have a Finance Organisational Model that you feel has not given you the expected return. In that case, we can discuss how to work with you and bring our expertise to bear.

You may be considering introducing (or deepening) a shared-service model or outsourcing services to a third-party provider. Alternatively, you might be looking to review the effectiveness and efficiency of your existing onshore organisation.

Our Experience

If you want to access experience, it may be worth knowing where we gained our shared-service knowledge. We have worked in one of the world’s most sizeable shared-service model set-ups covering six global shared-service centres across all continents.

Consequently, we can offer an in-depth analysis of any existing model you may have and provide recommendations for improvement based on tried-and-tested solutions to ensure your organisation maximises its benefits.

Our Expertise

The team has expertise in migration methodology, optimisation of activity penetration and integration of on- and off-shore teams, considering, of course, the effectiveness of the structure, skills and behaviours.

Our consultants welcome any discussion on the above and more, so please get in touch!

Alternatively, take a look at our most popular blog posts:

Or are you looking for something else? Here’s what we have been blogging about recently:

Agile Analytics Associates Automation Behaviours Building Trust Business-Partnering CFO Remit Change Management Coaching Collaboration Continuous Improvement Control Design Control Framework Corporate Governance Data Deployment Digital ERP ESG Finance Function Finance Transformation Implementation Migration Off-Shoring Organisation Organisation Design Process Process Design Process Improvement Process Performance Productivity Project Management Readiness Regulatory Compliance Risk & Controls Skills sponsorship Standard Organisational Model Strategy Systems Systems Design Technology Transformation Virtual Working